The latest from Alberto

Maximizing Solo 401k Contribution Deadline Benefits

Learn about the solo 401k contribution deadline and how to maximize your one-participant plan contributions before the annual deadline.

Read More

Maximize Earnings: Rollover 401k to IRA While Still Employed

Rollover 401k to IRA while still employed and access a wider range of investment options for retirement savings and growth.

Read More

Maximizing Solo 401k Deductions for Self-Employed Retirement

Maximize solo 401k deductions and retirement savings for self-employed individuals with expert tips on planning, contributions, and tax benefits.

Read More

457 Plan Early Withdrawal Penalty Rules Explained Simply

Learn about 457 plan early withdrawal penalty rules, fees, and tax implications to make informed decisions about your retirement savings.

Read More

EPFO PF Withdrawal Form: Online Process and Requirements

Submit EPFO PF withdrawal form online: Know the easy process, requirements, and documents needed for PF withdrawal from EPFO account.

Read More

Can I Move My Solo 401k to Another Company: A Guide

Learn how to transfer your Solo 401(k) to a new company, including rules and tax implications, to optimize retirement savings.

Read More

Maximizing 401k Loan Amount: Know the Risks and Benefits

Learn how 401k loan amount works and its consequences, including tax implications and potential penalties for early withdrawal.

Read More

Maximizing Retirement Savings with Fidelity Solo 401k Plans

Discover how to set up a Fidelity Solo 401k retirement plan, a tax-efficient savings option for self-employed individuals and small business owners.

Read More

Switching from SEP IRA to Solo 401k: A Comprehensive Guide

Learn how to switch from SEP IRA to Solo 401k, a more tax-efficient retirement plan, and maximize your savings with expert tips and guidance.

Read More

401k vs Brokerage Account: Smart Retirement Savings Choices

Difference between 401k and brokerage account: Which is best for retirement savings? Learn the pros and cons of each investment option.

Read More

Should I Rollover My 401k to New Employer or IRA?

Should I rollover my 401k to new employer or IRA? Learn the pros and cons of each option for retirement savings and make an informed decision.

Read More

Rollover 401k to Traditional IRA: Tax Implications Explained

Learn how a rollover 401k to traditional IRA affects taxes & understand the implications for your retirement savings & investments.

Read More

Etrade Solo 401k: Expert Self-Directed Retirement Planning

Learn how to set up and manage an Etrade Solo 401k plan for self-directed retirement savings, maximizing contributions and investment options.

Read More

Maximizing 401k with Self Directed Brokerage Account in 401k

Explore the benefits and rules of self directed brokerage accounts in 401k plans, a flexible investment option for retirement savings.

Read More

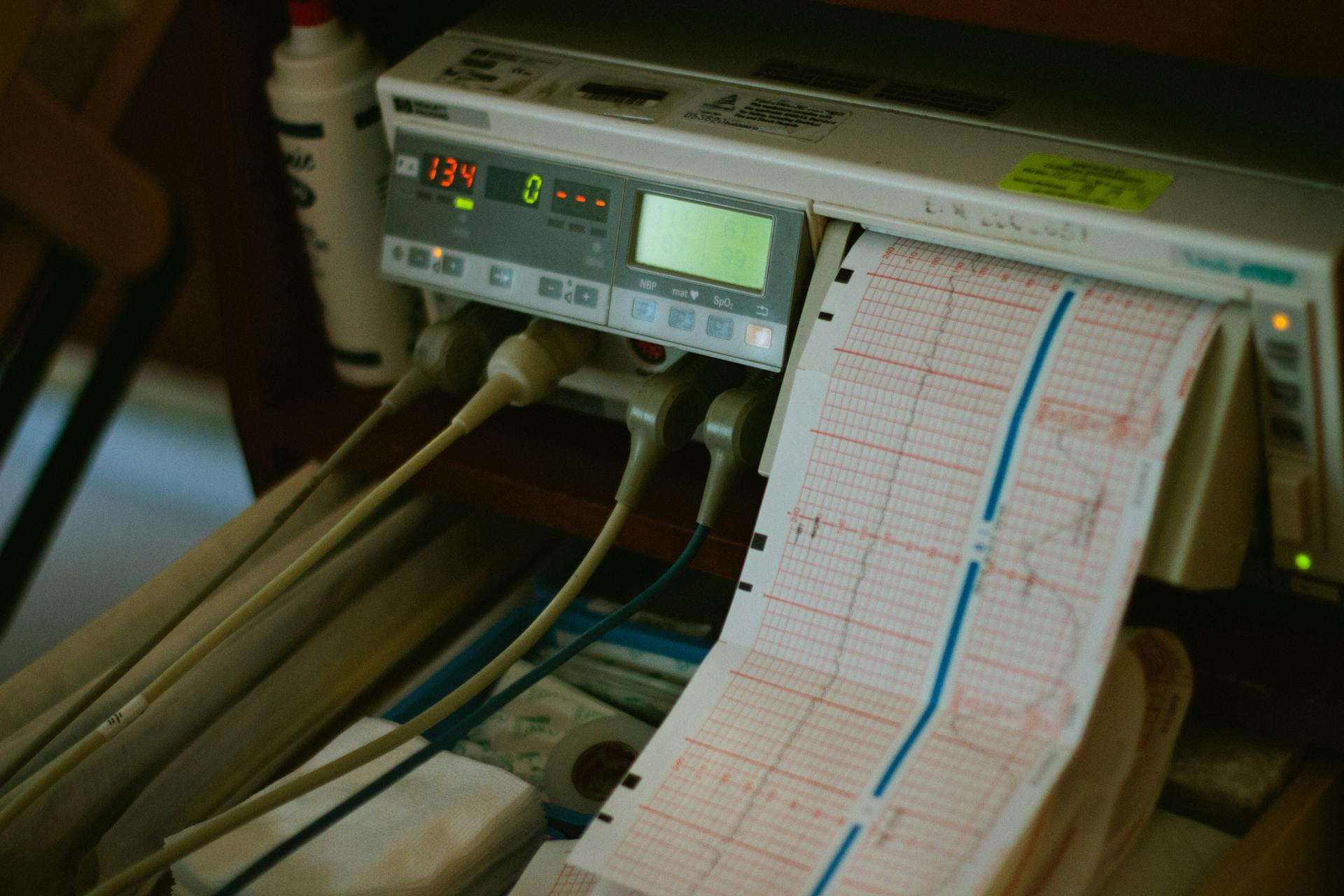

CFPB Medical Credit Cards: Managing Debt with Care

Learn how CFPB medical credit cards can help manage medical debt, understand payment plans, and protect your financial health.

Read More

Medical-bill Advocacy Services Simplify Patient Billing

Expert medical-bill advocacy services help patients and families navigate complex healthcare billing, reducing stress and ensuring fair coverage.

Read More

Rollover IRA into 401k: Simplify Your Retirement Savings

Learn how to rollover IRA into 401k and maximize retirement savings with tax benefits and consolidation of accounts.

Read More

Evaluating Solo 401k Providers for Your Retirement Savings

Discover the top solo 401k providers for your retirement savings, comparing fees, services, and investment options to secure a prosperous future.

Read More

Why Rollover 401k to IRA and Take Control of Your Retirement

Learn why rollover 401k to IRA and take control of your retirement savings with expert tips and strategies for a secure financial future.

Read More

Unlocking Profits with Btc Mining Pool Strategies and Tips

Discover the world of BTC mining pools with our comprehensive guide. Learn the basics of mining, pool types, and maximize your crypto profits.

Read More