The rental market trends in the U.S. can be difficult to understand, but it is important to stay informed to protect yourself and make the best decision for your situation. The 2017-2021 data from the U.S Census Bureau shows that rental costs are rising due to a variety of factors including inflation, higher costs for maintenance workers, repair costs, and landlords passing on their own higher costs onto renters. This creates a cycle where renters have higher rent costs which contributes to higher rents overall and then the cycle repeats itself. Vacant rental properties and expired rent freezes have resulted in fewer discounts from landlords, while pandemic-era rent freezes have been followed by steep discounts in urban areas as landlords look for tenants and hike prices for lease renewals.

There has been a significant shift in the workforce during this pandemic with an increased demand for remote work as deep-pocketed renters sought larger homes which contributed to an increase in rents overall. Migration into suburban areas has also created a net increase of prospective renters who are driving up one-bedroom apartment prices according to a November 2022 report from real estate website Streeteasy. Homeownership is proving difficult as prospective homeowners remain renters due to high demand and low inventory of existing homes plus rising mortgage interest rates, supply chain disruptions, and higher mortgage rates over the past year when housing prices cooled faster than usual at a much slower pace than the rapid clip before that promising development began multifamily construction until 2022 when it reached its 50-year high nationwide according to Rental Listing Service Rentcafe.

Rent costs remain unaffordable for many Americans due largely to rising interest rates causing delays or cancellations of major rental projects leading up until Jan 25th when the Biden Administration proposed their "Renters Bill" with federal actions aimed at promoting rental affordability which includes guidelines that strengthen tenant protections.

Rent: On the Rise or Decline?

Rent is on the rise, according to Zillow's analysis of recent housing data. December 2022 rent growth was up an impressive 3.2%, with further increases projected for February 2022. This trend highlights the importance of staying abreast of the latest rental market trends - and taking action accordingly.

Top 10 most-affordable cities by rent-to-income ratio

As rental market trends continue to evolve, determining the most-affordable cities by rent-to-income ratio is becoming increasingly important. While some of the most popular cities may not be listed, you can often find affordability in the closest metro area. With that in mind, here are the top 10 most affordable cities by rent-to-income ratio.

A different take: Rental Income and Expenses

Discover the Best Rental Property for Your Investment

Discovering the best rental property for your investment can be a daunting task. Knowing which type of real estate to look at, and what to prioritize when making a decision are essential components of being successful in the rental market. Expert investors know that it’s often better to buy one single-family home instead of an entire apartment complex or industrial property; this way you can focus on finding a good rental property, rather than having to juggle multiple units.

Single-family homes with 3 bedrooms and 2 baths offer an excellent family chances while also providing more stability than a duplex, triplex, or condo. Buying a single-family home makes it easier to find good tenants who will pay full retail price and appreciate faster than average buyers would. Additionally, if you buy in a good neighborhood with good schools close by and plenty of local amenities, you may even get higher quality tenants at even more affordable price points.

Whether you decide to stick with single-family homes or go for a multi-unit property such as multi-family homes, it is important to remember that buying the right property is the key to making money in real estate investing. Do your research before you make any decisions and don’t forget that good properties come at a premium so make sure you are willing to pay full price for them!

For your interest: Buy Market

Gaining Insight on Investment Properties: An Analysis Guide

Investors looking to enter the rental market should be aware of potential investment properties and their projected rent. Assuming you’ve found an area with a desirable population (i.e. a metro area with 1 million people), you can begin to look at single-family homes in the median range. Don't forget to include closing costs, escrow fees, taxes, potential vacancy, and mortgage fees when calculating expenses. Remember that these expenses will directly affect your cash flow analysis equation and should account for monthly rent appreciation and property yearly increase in value (plus any tax breaks).

When it comes to deciding on a good rental property, numbers speak louder than words. If you’ve broken down all the numbers correctly and know what kind of investment strategy you want to pursue, you can use them to produce positive cash flow from the property. However, if you’re unsure about how to calculate cash flow returns or need help with a free cash flow analysis spreadsheet, it's always worth taking some time out to visit the property before making decisions.

To recap: Here's what you need for a good rental property - an area with desirable population numbers; single-family homes in the median range; accurate calculations of expenses; an understanding of your investment strategy; and finally, adequate research into appreciation rates and tax benefits. With this information at hand, investors can make informed decisions about which properties are right for them.

Here's an interesting read: Before Buying Rental Property

Frequently Asked Questions

What percentage of rent should I use?

Rent expenses should typically comprise no more than 30-50% of your monthly income. To find out what percentage of rent is best for you, it's important to consider factors such as your income, existing debt, and other financial obligations.

What should I look for in a rental property?

When searching for a rental property, you should look for a place that meets your needs in terms of location, amenities, and monthly cost. Additionally, make sure to inspect the property for any damage or maintenance issues prior to signing a lease agreement.

Is the US housing market running strong?

Yes, the US housing market is strong and continues to show growth. With historically low-interest rates, now is a great time to explore your options for buying or refinancing a home. Learn more about current US housing market trends now!

How do I determine the value of my rental property?

The best way to determine the value of your rental property is by getting an appraisal from a qualified professional. An appraisal provides an accurate estimate of your rental's current market value, taking into account its location, condition and other factors.

Is the US rental property market falling?

No, the US rental property market is not falling. In fact, it's increasing in value due to strong demand and a lack of supply, making it an attractive investment option for those looking to expand their portfolio.

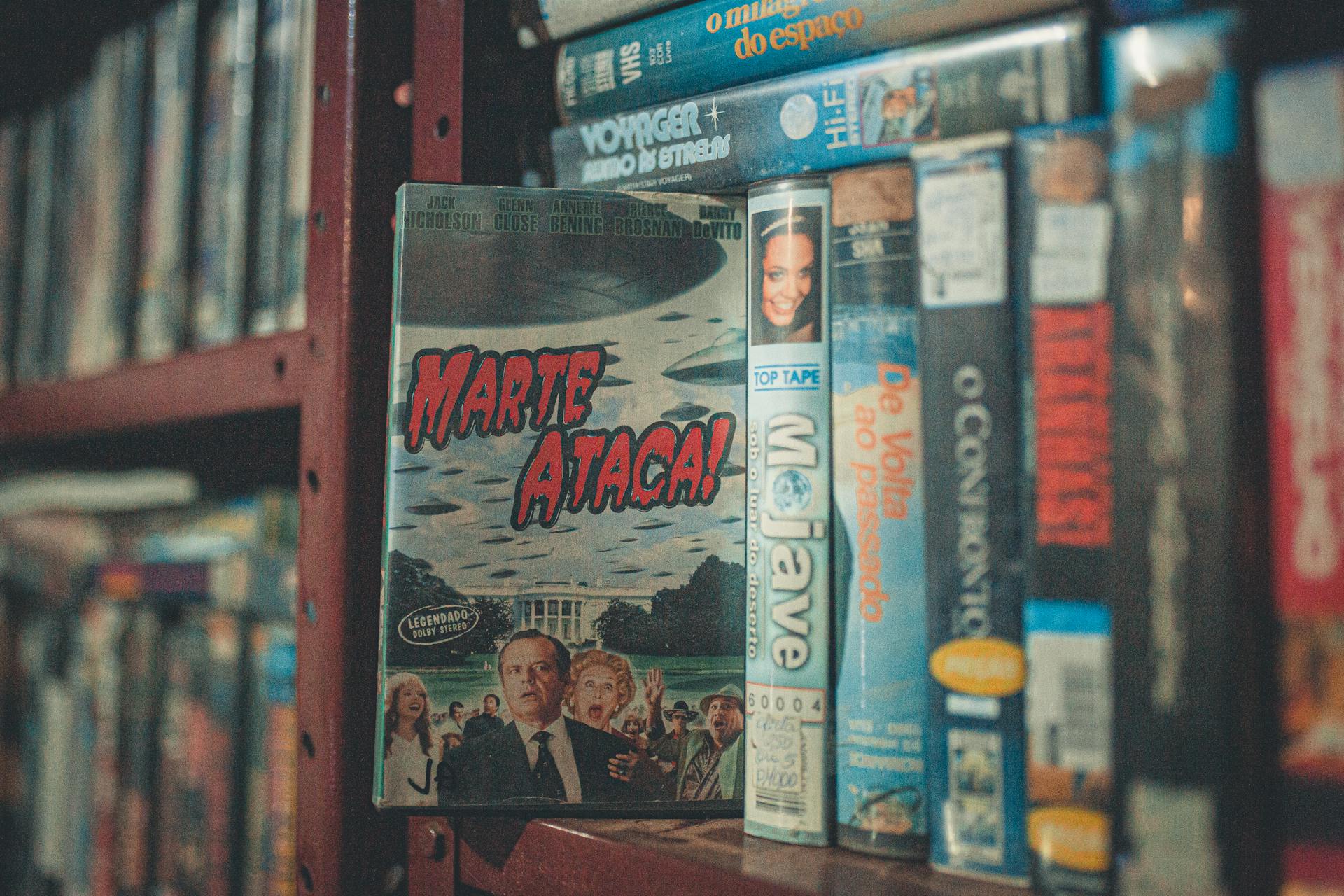

Featured Images: pexels.com