Open a brokerage account and take control of your investments. As an investor, you have many options when it comes to opening a brokerage account - each offering different advantages. Typically, you can complete an online application in as little as 15 minutes, giving you access to the markets and allowing you to reach your short-term goals. Brokerage accounts can also include tax-advantaged accounts such as retirement savings that allow you to save for the future.

When choosing which type of brokerage account to open, investors must consider the fees associated with each option. While many brokers offer free trading, others may charge per transaction or require a minimum investment amount. Additionally, some brokers offer support for advanced traders who may be interested in more complex strategies such as margin trading or derivatives products.

For those just starting out, it's important to understand the differences between different types of brokerage accounts and how they can help reach your financial goals. By researching the various options available and comparing costs and features from various online brokers, investors can make informed decisions about where to open their accounts and begin investing with confidence.

Expand your knowledge: How to Purchase Stock without a Broker

Uncovering the Mystery of Brokerage Accounts

A brokerage account is an investment account that allows you to trade assets such as stocks, bonds, and mutual funds. They are usually managed by pricey full-service stockbrokers or low-fee online discount brokers. If you’re ready to jump into the basics of a brokerage account, here’s what you need to know.

First, you will need to transfer money from your bank account into your brokerage account in order to begin trading. Unlike banks, brokerage accounts give you the freedom to buy and sell shares in the stock market - which can be a good way to make extra income if done correctly.

Brokerage accounts can be called taxable accounts - meaning that any investment income earned may be subject to taxes. Capital gains taxes may also apply if money is withdrawn from the account. On the other hand, retirement accounts have different withdrawal rules and tax advantages for retirement savings. Delyanne Barros, founder of Money Coach says “For long-term investors who are in a favorable tax bracket it might be beneficial for them to stay invested and ignore day-to-day stock market noise and have their current taxable income taxed at their long-term capital gains tax rate." Don’t forget to compare different brokerage accounts when selecting an online broker!

You might like: Charles Schwab Pattern Day Trading

Unlocking the Benefits of a Brokerage Account

Opening a brokerage account is a great way to unlock the benefits of investing. The process typically takes just 15 minutes and can be completed online, making it easier than ever to get started. Here's how to open your own brokerage account:

First, you'll need to select a broker. States are often specific about which broker you'll use, so make sure you research what's available in your area. Once you've chosen a broker, it's time to complete an online application. This will include details such as your name and address and information about your bank account from which you'll transfer funds. Though it may sound complicated, opening a brokerage account is actually pretty simple and usually only requires a small sum of money to get started. You'll confirm the exact amount when you apply for the account.

Once you have your brokerage account set up, you can start investing right away! Brokers offer two different types of accounts: cash accounts and margin accounts. A cash account allows buyers to purchase stocks with their own money while margin accounts allow investors to borrow money in order to make trades – though this type of account is generally considered more risky as it involves paying interest on any borrowed money. No matter which type of brokerage account online you choose, brokers make it easy for investors to start investing quickly and easily!

See what others are reading: Offshore Brokerage Accounts

Open the Door to Possibilities: Start Your Account Now

Open a brokerage account today and unlock the possibilities of investing in the stock market. With a brokerage account, you’ll gain access to a range of investment opportunities, from stocks and bonds to ETFs and mutual funds. Start your journey towards financial freedom now by opening your brokerage account today – the doors of possibility are wide open!

Innovative Small Business Options to Try

If you are looking to start a small business, there are several unique and innovative options available. One great choice is to open a brokerage account. A brokerage account allows you to save and invest funds for retirement or other long-term goals. It also offers tax-deferred growth and generally offers multiple owner SEP-IRA, individual 401k, simple IRA, and 403b plan options.

When opening a brokerage account, you will need to provide personal information such as your start date, annual income, and household net worth. Additionally, if you would like more information on any of the retirement plan options mentioned above, you can call 800-992-7188 from Monday through Friday between 8 PM Eastern time and 4 PM Pacific time.

For those working in public education institutions or tax-exempt organizations with the option for Roth contributions, you can call 877-859-5756 from Monday through Friday between 8 PM Eastern time and 4 PM Pacific time for more information on SEP-IRA plans. With all these innovative options available, opening a brokerage account can be an ideal retirement plan choice for small businesses.

Related reading: Reits for Retirement Income

Comparing Brokerage Accounts and IRAs

When deciding whether to open a standard brokerage account or an IRA, it’s important to understand the differences between the two. With a standard brokerage account, you are contributing post-tax money that can be used for investments, generating investment earnings. Earnings, such as capital gains, dividends, and interest can be withdrawn including the earnings without paying additional taxes.

A Roth IRA is another option where you contribute post-tax money but have the benefit of withdrawing your money tax-free in retirement. This is an ideal situation if you’re looking to save money over a long period of time and not pay any tax on your earnings when you take them out. However, compared to a brokerage account that allows you more flexibility in terms of withdrawals and transfers, it may not be the best option for everyone.

Finally, some companies offer employer-sponsored plans like 401(k)s which we recommend contributing to if available. Comparing a taxable brokerage account versus traditional or Roth IRA accounts can be daunting but understanding how each works is essential for planning for retirement.

Take a look at this: Tax Treatment Gold Etf Roth Ira

Discovering the Perfect Brokerage Account Provider

Investing your money is an important financial decision and finding the right provider for your brokerage account can be a daunting task. Wendy Moyers, a certified financial planner at Chevy Chase Trust in Bethesda, Maryland offers some valuable advice on how to pick an online broker that best suits your needs.

When searching for the perfect brokerage account provider, it’s important to look for an online broker that offers both taxable brokerage accounts and retirement accounts. Both of these are great options for investors as they provide tax advantages and are available at competitive rates. Investigate what other services the brokers offer such as research tools and customer service to ensure you’re getting the best deal possible.

Related reading: Buy Berkshire Hathaway B Shares

Frequently Asked Questions

What are the benefits of opening a brokerage account?

Opening a brokerage account can give you access to a wide range of investment products, from stocks and bonds to mutual funds, ETFs, and more. It also provides you with the opportunity to benefit from stock market growth and diversify your investments for greater financial security.

How do you open a brokerage account?

To open a brokerage account, you'll need to find an online broker and follow their steps for opening an account. Once complete, you'll have access to the stock market and be able to buy and sell securities. Get started today!

What to know about opening an investment account?

Opening an investment account can be a great way to grow your savings and reach your financial goals. To learn more, read our guide on the steps to opening an investment account and what you need to know before getting started.

What are the different types of brokerage accounts?

There are three main types of brokerage accounts: Cash, Margin, and Retirement Accounts. Each type of account has its own unique features and benefits, so it's important to understand the differences before deciding which one is right for you.

How to choose the right investment account?

Choosing the right investment account can be tricky. To ensure you make the best decision for your financial future, it's important to do research and compare different accounts to find one that suits your needs. Start by evaluating your current financial goals and risk tolerance to narrow down the selection of accounts.

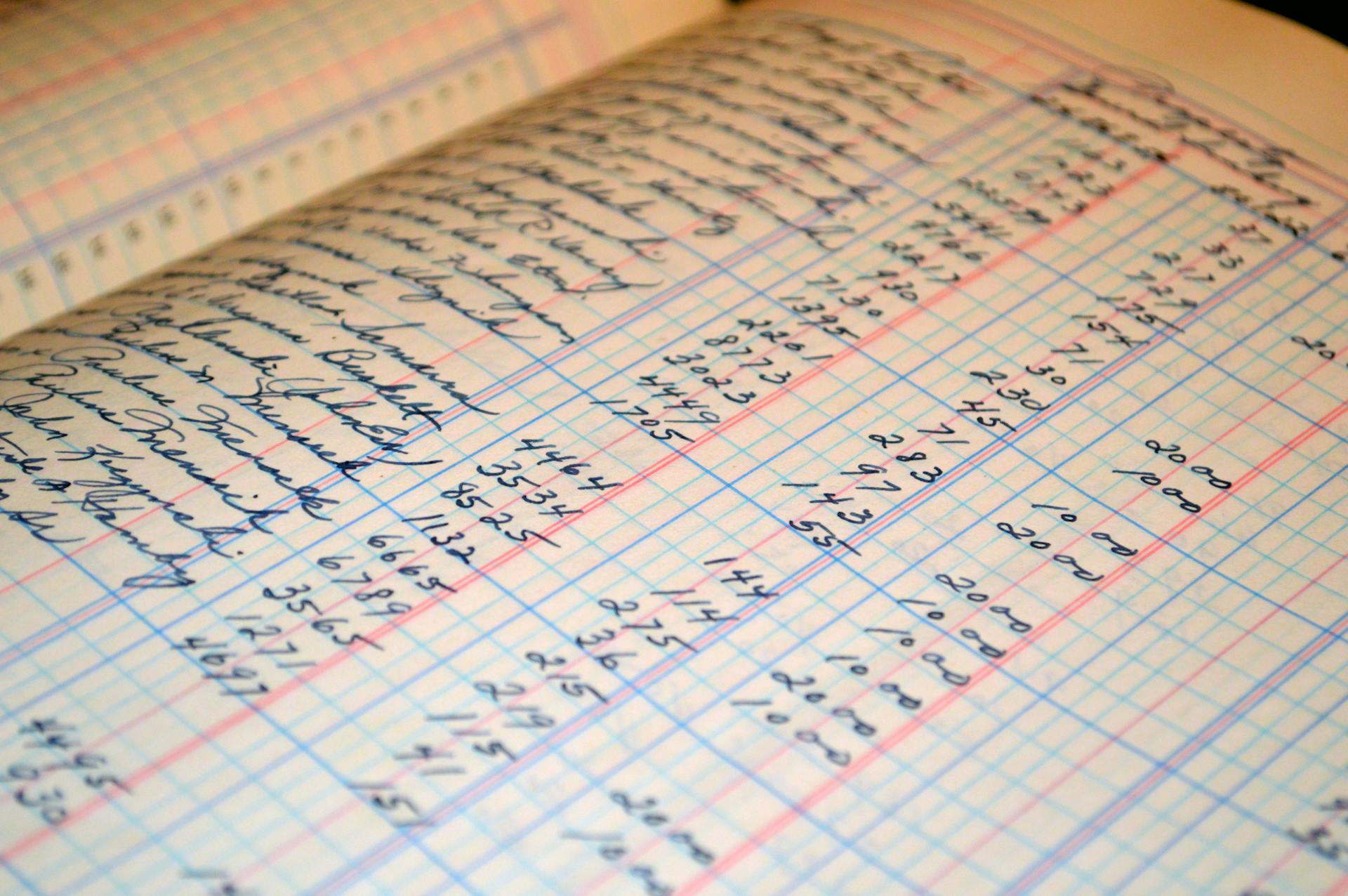

Featured Images: pexels.com