Modifying your KYC (Know Your Customer) registration is a crucial step in staying compliant with regulatory requirements.

You're required to update your KYC information within 30 days of any change, which includes changes to your name, address, or identification documents.

This ensures that your customer due diligence is up-to-date and accurate, preventing potential issues with regulatory bodies.

Failure to comply can result in fines and reputational damage to your business.

Readers also liked: Know Your Customer News

When to Update KYC?

You'll only need to update your KYC details in rare cases, such as when you've changed your name on your PAN card, Aadhaar card, or passport. This requires submitting scanned copies of your latest documents.

If you've shifted to a new home, or changed your address after marriage, you'll also need to update your KYC details. This includes updating your address in all your ID proofs, such as your Aadhaar, passport, and other documents.

Updating your KYC details is a one-time process, unless you change your address or name again. In that case, you'll need to update your KYC details once more.

Here are some scenarios when you'll need to update your KYC details:

- Changing your name on your PAN card, Aadhaar card, or passport

- Shifting to a new home, or changing your address after marriage

These updates will ensure that your financial history and transactions are accurate and secure.

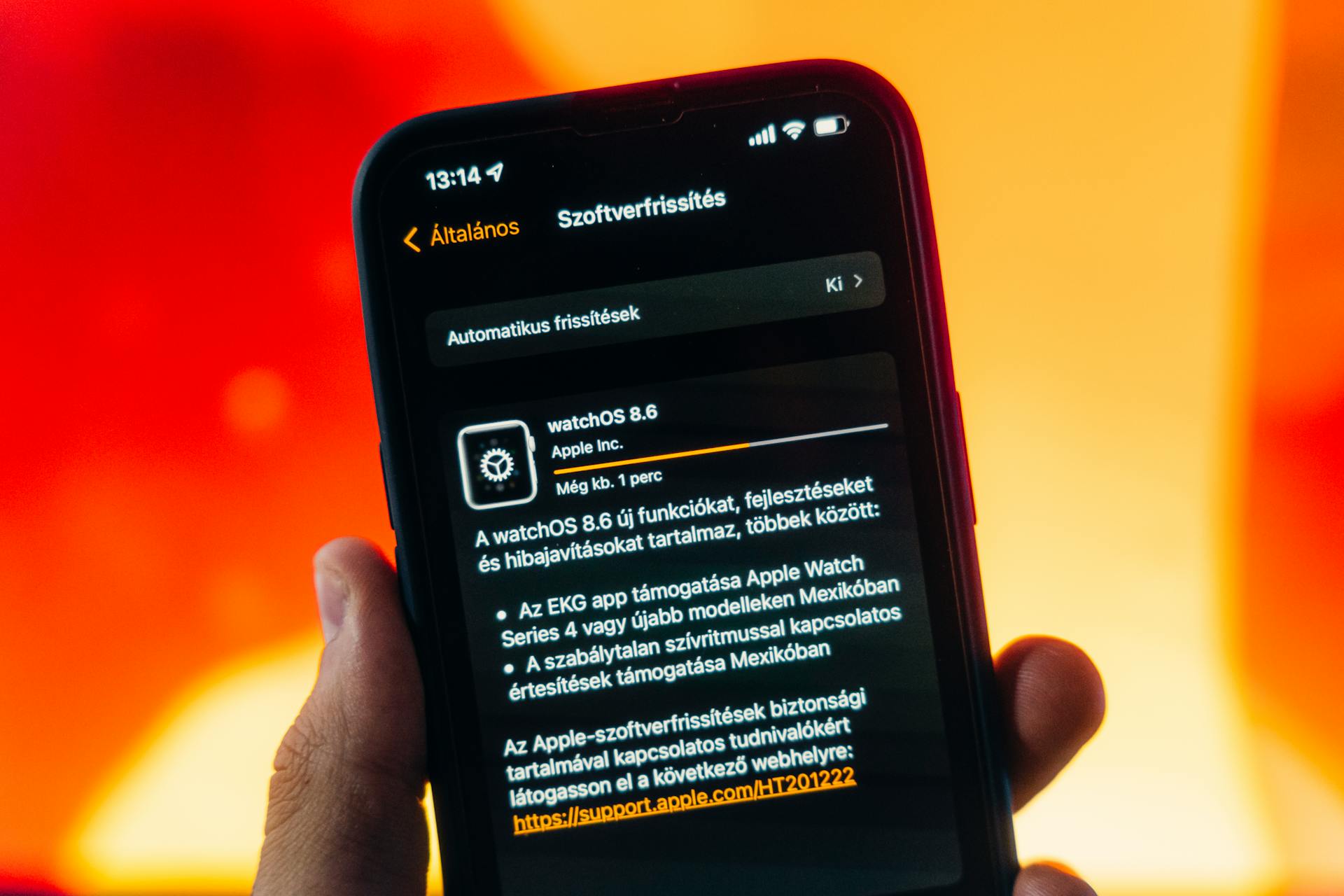

Updating KYC Online

Updating your KYC online is a straightforward process that can be done from the comfort of your own home. You can log in to the online KYC portal using your credentials and navigate to the "Update KYC" option in the settings.

The online KYC portal will guide you through the update procedure, where you can make changes to your KYC details by uploading the latest scanned copies of required documents. You will also need to enter a one-time password for verification.

You can update your KYC details online if you have changed your name or address. This is usually done when you have legally changed your name or moved to a new address, and you need to update your PAN card, Aadhar card, or passport.

Here are the steps to update your KYC online:

- Log in to the online KYC portal using your credentials

- Navigate to the "Update KYC" option in the settings

- Make changes to your KYC details by uploading the latest scanned copies of required documents

- Enter a one-time password for verification

- Submit your application for KYC details update

You can also use the online portal to update your address, name, phone number, and other details. This will ensure that your KYC details are up-to-date and accurate, which is essential for regulatory compliance and risk management.

Updating your KYC online has several advantages, including regulatory compliance, improved safety, improved service, easier transactions, risk management, access to financial services, and trust and transparency. By keeping your KYC details up-to-date, you can enjoy these benefits and have a smoother experience with financial transactions.

Worth a look: Kyc Risk

Key Points for KYC Updates

To update your KYC online, you simply need to log in to the online KYC portal using your credentials. You will then find an option called “Update KYC” in the settings, click on it, and make the necessary changes by uploading the latest scanned copies of required documents.

When updating your KYC, it's essential to ensure that the documents you upload are not tampered with, as they will go through multiple levels of checks and verifications. You can also update your KYC physically by visiting a KYC kiosk, bank, or AMC branch along with the scanned copies and originals of required documents.

To keep your KYC up-to-date, it's recommended to update your information on a regular basis, especially if there's a variation in your personal or financial information. Make sure to carry valid identification, proof of address, and other relevant documents when updating your KYC, and be aware of any deadlines set by the financial institution to avoid penalties or disruptions in your services.

Here are some key points to keep in mind when updating your KYC:

- Update your KYC information regularly.

- Carry valid identification and proof of address.

- Be aware of deadlines set by the financial institution.

- Ensure all information provided is accurate and current.

Things to Keep in Mind

When updating your KYC, it's essential to be aware of a few key things.

You'll need to ensure that scanned copies of your original documents are not tampered with in any way, as this is the final layer of verification in a digital KYC process.

If you're updating your KYC online, it's crucial to fill out the form accurately, as any mismatch in details will be immediately notified.

In case of an offline update, you'll need to physically visit a KYC kiosk, bank, or AMC branch along with the required documents.

To avoid any issues, make sure to update your KYC information on a regular basis if there's any variation in your personal or financial information.

You'll need to carry valid identification, proof of address, and other relevant documents that the institution may require for the update.

Be aware of the deadlines set by the financial institution for KYC updates, as failing to meet them may result in penalties or disruptions to your services.

All information provided during the update process should be accurate and current to avoid any problems with your accounts.

Suggestion: Kyc Update Online

What to Do After KYC Registration?

If the KYC is registered, you can continue to make transactions such as purchases, redemptions, or switches or SIPs in your mutual fund investments without any hassle.

You can get your KYC status changed to KYC Validated by doing the KYC updated/KYC modification process using PAN and Aadhaar from XML, Digi-locker or m-Aadhaar.

Aditya Birla Sun Life Mutual Fund provides a link to modify your KYC at https://mutualfund.adityabirlacapital.com/campaign/modification-of-kyc.

PPFAS Mutual Fund also offers a self-invest portal at https://selfinvest.ppfas.com/re-kyc for re-KYC.

Broaden your view: Re Kyc

Mutual Fund KYC: Verify Online and Fix Gaps

To modify your KYC details, you can update them online through the KYC portal. Simply log in to the online KYC portal using your credentials.

The update procedure is quite simple and can be done without physically visiting a kiosk. You'll find an option called “Update KYC” in the settings, click on it.

An interface will open up where you can make changes to your KYC by uploading the latest scanned copies of required documents. You'll need to enter the required fields and proceed with the verification process.

To complete the verification process, you'll need to enter a one-time password (OTP). After entering the OTP, click on the submit button to submit your application for KYC details update.

Your application will be reviewed, and you'll receive an official notification regarding your KYC verification within a few days.

Related reading: Kyc Steps

Frequently Asked Questions

How to change KYC status from KYC registered to KYC validated?

To change your KYC status from 'KYC Registered' to 'KYC Validated', update your KYC details using PAN and Aadhaar through XML, Digi-locker, or M-Aadhaar. This process is simple and takes a few minutes to complete on Mutual Fund/RTA websites.

What is the difference between KYC registered and KYC validated?

KYC Validated documents are directly authenticated by the issuing authority, while KYC Registered/Verified documents cannot be independently verified by the authority

How do I correct my KYC details?

To correct your KYC details, visit your home branch with a signed Re-KYC form and a copy of your valid KYC documents. You can also submit a self-declaration form by email, post, courier, or physical delivery if there's no change in your KYC information or address.

Sources

- https://cleartax.in/s/kyc-update-online

- https://www.moneycontrol.com/news/business/personal-finance/do-you-need-to-redo-your-mutual-fund-kyc-it-depends-on-your-kyc-status-12621501.html

- https://www.indiainfoline.com/knowledge-center/kyc/how-to-update-kyc-details

- https://www.livemint.com/mutual-fund/mutual-fund-kyc-status-5-key-things-investors-should-know-investments-11716975763487.html

- https://www.businesstoday.in/mutual-funds/story/mutual-fund-kyc-heres-how-to-verify-your-status-online-and-fix-gaps-428180-2024-05-03

Featured Images: pexels.com