Halted trading stocks can be a confusing and frustrating experience for investors.

The SEC can halt trading on a stock due to a number of reasons, including financial reporting issues or other corporate governance problems.

This can happen at any time, without warning, and can affect both individual investors and institutions.

Trading halts can be temporary or permanent, and the SEC will typically provide a reason for the halt.

On a similar theme: Why Does the Sec Regulate the Trading of Stocks

What Is a Halted Stock?

A halted stock is a security whose trading has been temporarily suspended by regulatory authorities. This can happen at any time of the day and may occur more than once in a single trading day.

Regulatory bodies have the power to impose trading halts on specific stocks or a group of stocks. These halts can take place in one exchange or across multiple exchanges.

Trading halts can be imposed at any time, and there's no fixed rule regarding their frequency or duration. This means that a halted stock can be trading one minute and halted the next, with no warning.

Causes and Reasons

Trading halts can be triggered by a variety of reasons, and understanding these causes is crucial for investors and traders.

Major corporate transactions, such as mergers or acquisitions, can lead to a trading halt due to the significant impact on the company's stock price.

Significant information about a company's products or services can also cause a halt, whether it's positive or negative news.

Regulatory developments that may affect a company's ability to do business can lead to a trading halt, ensuring that all investors have access to the same information at the same time.

A company's financial health is another key factor, with significant changes leading to a halt.

There are typically two types of trading halts: regulatory and non-regulatory.

Regulatory halts are issued based on specific rules, such as a company releasing material news that could impact its stock price.

Exchanges may also pause trading if it's uncertain that the company still meets its listing standards.

Non-regulatory halts can happen in more subjective situations, such as a major imbalance in buy and sell orders for a security.

A trading halt can be triggered by a severe drop in the market or a series of continuous drops.

The entire exchange may impose a trading halt, referred to as a "trading curb", in such cases.

Here are the common reasons for a stock halt:

- Major corporate transactions (such as a merger or acquisition)

- Significant information about the company’s products or services

- Regulatory developments that may affect the company’s ability to do business

- Significant changes to the financial health of the company

How it Works

A trading halt can be regulatory or non-regulatory. Regulatory halts are applied when there's doubt the security continues to meet listing standards to give market participants time to assess important news.

Regulatory halts ensure wide access to the news likely to move the price and prevent those who receive it first from profiting from others late to the information. This is especially true in cases like a U.S. Food and Drug Administration decision on a new drug application.

A regulatory trading halt in a security by its primary U.S. exchange is honored by other U.S. exchanges. This means that if a halt is implemented on one exchange, it will be respected on others.

You might enjoy: Stock Exchange

Non-regulatory trading halts can occur on the New York Stock Exchange (NYSE) to correct a large imbalance between buy and sell orders. They typically last no more than a few minutes until order balance is restored.

Companies often wait until the market closes to release sensitive information, giving investors time to evaluate it. However, this can lead to a large imbalance between buy orders and sell orders in the lead-up to the market opening.

The Securities and Exchange Commission (SEC) has the power to impose a suspension of trading in any publicly traded stock for up to 10 days.

Readers also liked: Pre Market Trading Stocks

Examples of

Stock trading halts can occur for a variety of reasons, including the release of material news that affects the stock's price.

Company A, a real estate investment trust (REIT), recently completed an acquisition of major properties in Canada, and the exchange that it trades on halted its stock to allow investors to digest the new information.

Trading halts can also be caused by unusual market activity, such as a 570% increase in Viabuilt Ventures, Inc.'s stock price in just six weeks.

The SEC maintains a website that lists all of its historical trading halts and suspensions, including the suspension of Viabuilt Ventures, Inc. due to indications of market manipulation.

In some cases, trading halts may be requested by the company itself, such as when six executives of Sundance Resources Limited went missing on a flight over Africa, and the company asked for a trading halt to properly disseminate the news.

Circuit breakers can also trigger market halts, as seen during the COVID-19 pandemic, when circuit breakers were triggered on March 9, 12, 16, and 18, 2020.

Take a look at this: London Stock Market Open Time Est

Impact and Consequences

Trading halts can have significant consequences on the market, particularly in the lead-up to critical news or announcements from companies. Companies often release such news at the end of the trading day to give investors time to absorb the information.

A significant imbalance between buy orders and sell orders can occur in the lead-up to the market opening of the subsequent day. This can result in a trading halt as soon as the market opens.

These delays are usually very short and intended to restore the balance between buy orders and sell orders. This is referred to as ‘held at open’ because trading has been halted at the time of market opening.

A 10% change in the value of a security within 5 minutes can invoke a trading halt for companies that are a member of Standards and Poor’s (S&P) 500 Index.

Recommended read: How Do You Trade Shares on the Stock Market

Circuit Breakers and Suspension

Circuit breakers are like safety valves in the stock market, designed to prevent panic selling and give everyone time to figure out what's going on. They trigger a market-wide trading halt if the S&P 500 index declines by 7% or 13% in a single day.

A 20% decline in the S&P 500 will pause trading for the remainder of the day, no matter when it happens. This is to prevent a complete market meltdown.

Circuit breakers also apply to individual stocks, with different thresholds based on the size and value of the company. For stocks priced above $3 and included in the S&P 500 or Russell 1000 indices, trading is halted for five minutes after a sudden move of more than 5% and lasting more than 15 seconds.

Here are the thresholds for individual securities:

Circuit Breakers

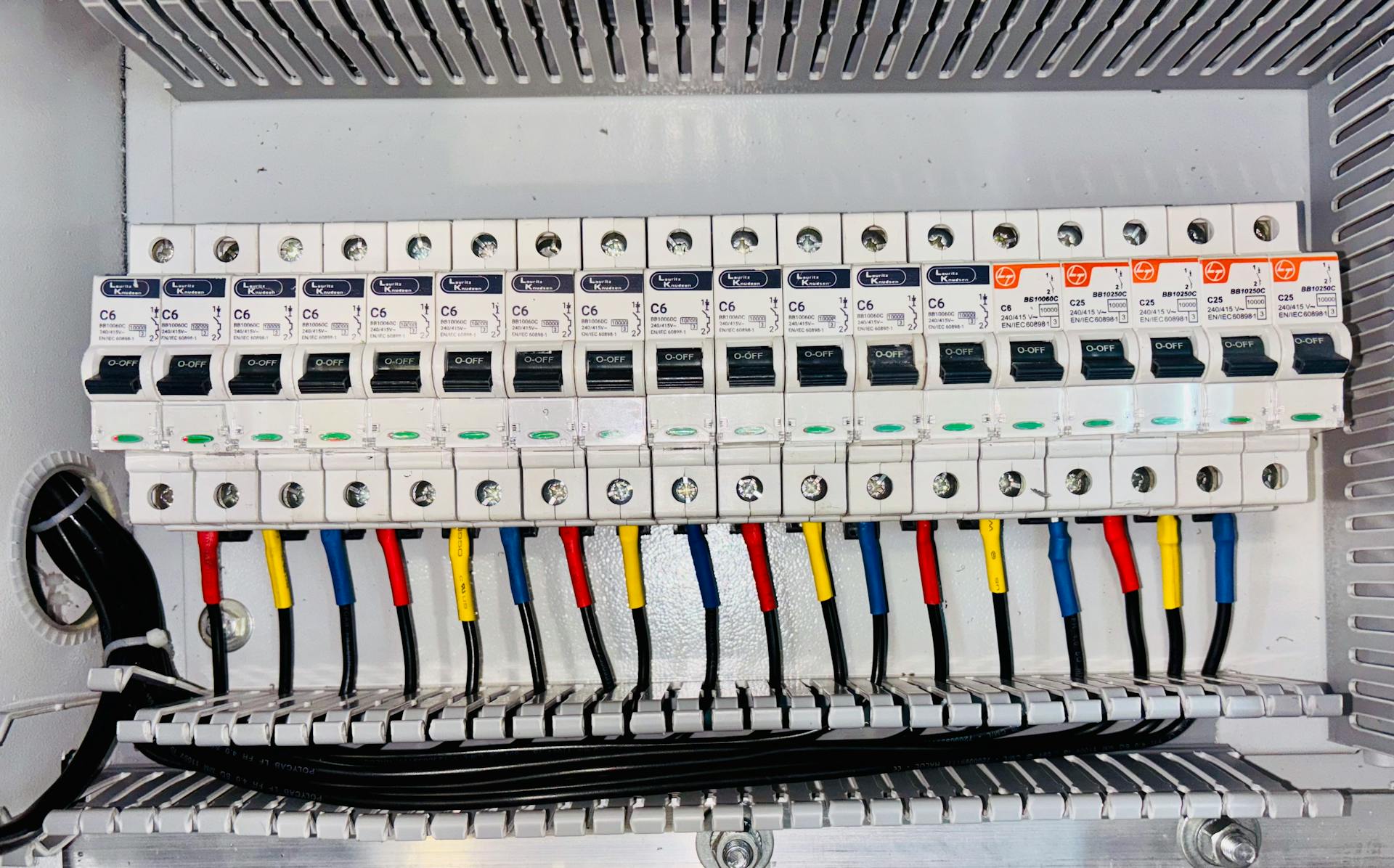

Circuit breakers are designed to stop panic selling in the market by halting trading for a short period of time. They work similarly to circuit breakers in electrical systems, kicking in when something goes wrong or gets overloaded.

A 20% decline in the S&P 500 from the prior day's close will halt trading for the remainder of the day. This is a critical threshold that triggers a market-wide trading halt.

Cumulative declines of 7% and 13% from the prior day's closing level in the S&P 500 index trigger a 15-minute market-wide trading halt if they occur before 3:25 p.m. ET. This allows the market to take a temporary break before resuming trading.

Trading halts can also apply to individual stocks, with thresholds varying based on the size and value of the company. For stocks priced above $3 and included in the S&P 500 or the Russell 1000 indices, trading is halted for five minutes after sudden moves of more than 5% and lasting more than 15 seconds.

Here's a breakdown of the trading halt thresholds for individual stocks:

For most people, trading halts and suspensions are often unnoticeable, and chances are you won't have to worry about how they impact your portfolio.

Suspension

A trading suspension is a serious measure imposed by the SEC, blocking the trading of a stock across all US stock exchanges.

This is typically done when the SEC has concerns about the availability of information about the company or potential market manipulation.

A trading suspension lasts for ten days, giving the SEC time to investigate potential fraud.

The SEC uses trading suspensions to protect investors, and they're not taken lightly.

In most cases, a trading suspension is a strong indicator that something is seriously wrong with the company.

Frequently Asked Questions

How long can a stock be halted for?

A stock trading halt typically lasts less than an hour, but can be longer in exceptional cases. The duration of a halt is usually short, allowing trading to resume soon after.

How to tell if a stock is halted?

A stock is halted if you see a halt code on the ticker when trying to trade it, or if you receive a trading halt alert from your platform. You can also set up automatic alerts for halted stocks through services like StockNinja.io.

Who controls trading halts?

Trading halts are controlled by securities exchanges, which are self-regulatory organizations with the authority to develop and enforce their own rules and standards. This means they have the power to pause or delay trading in a stock.

Sources

- https://www.investopedia.com/terms/t/tradinghalt.asp

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/stock-halt/

- https://www.forbes.com/sites/qai/2022/11/19/halted-stockswhy-the-sec-and-stock-exchanges-pause-trading/

- https://www.angelone.in/knowledge-center/online-share-trading/what-is-a-trading-halt

- https://trendspider.com/learning-center/trading-halts/

Featured Images: pexels.com