Are you looking for a way to get cash quickly? Perhaps you need it to pay off some debts, make an emergency purchase, or cover unexpected expenses. Whatever the reason may be, cd loans can provide you with the funds you need. CD loans are personal loans that use a certificate of deposit as collateral.

CD loans are a popular option for people who want to rebuild their credit. If you've had trouble getting approved for traditional loans in the past due to bad credit, CD loans may be your answer. By using your CD as collateral, lenders have more security and are more likely to approve your application.

In this article, we'll explain how CD loans work and what you need to know before applying for one. We'll also discuss the benefits of using a CD loan to rebuild your credit and how you can get started on securing a CD loan today. So, if you're interested in learning more about how CD loans can provide cash when you need it most, keep reading!

A different take: What Can You Use for Collateral for a Loan

Learn About the Benefits of a CD Loan Today!

What is a CD Loan? A CD loan or certificate of deposit secured loan is a type of personal loan that requires collateral. Unlike unsecured loans like credit cards, CD loans offer lower interest rates and more favorable terms because they are secured by the funds in your CD account. If you need financing for a significant purchase, such as a car or home improvement project, a CD secured loan may be the right choice for you.

Why choose a CD Loan? Compared to other types of secured loans like auto loans and mortgages, CD loans are typically easier to obtain and have fast approval times. You can usually receive your funds within one business day depending on the lender you choose. Moreover, if you stop making payments on an auto loan or mortgage, you could lose your car or house. However, with a CD loan, your collateral is already in place so that you won't risk losing it.

Where to get a CD Loan? Most banks and credit unions offer cd loans to their customers. However, before signing up for any financial product, it's essential to shop around and compare interest rates and terms from different lenders. By doing so, you'll know which option is best suited for your financial situation. In addition, some institutions require that you have an existing relationship with them before applying for a cd loan so make sure to check with them beforehand!

Additional reading: Financial System

Different Options for Financing Other Than CD Loans

Looking for financing options other than CD loans? Don't worry! There are many alternatives to explore. One is to check out similar options, such as savings-secured loans. These types of loans use your savings account as collateral, and typically feature fixed-rate terms enabling you to pay a monthly payment.

Another option is unsecured loans. Unlike CD loans or savings-secured loans, unsecured loans don't require collateral. However, they may be harder to qualify for if you don't have good credit. Interest rates on unsecured loans may also be higher than those on secured loans.

Secured credit cards are another great option if you're looking for a specific amount of cash deposit. These cards offer great benefits and may eventually qualify you for an unsecured credit card. Loan banks often offer same-day approval on secured credit cards, so it's worth checking them out if you're in need of financing without using your savings as collateral.

Curious to learn more? Check out: Creative Financing for Business Purchase

Get Approved for a CD Loan with These Simple Steps

If you're looking to secure funding for a big purchase or investment, a CD loan might be your answer. Here are the basic steps to follow to get approved for a CD loan:

First, compare CD loan terms from different lenders to ensure you're getting the best deal. Then, gather all the required documents you'll need, including personal and financial information. Once you've submitted your application, the lender will determine if you're financially responsible and what payment terms they can offer based on your financial picture.

Keep in mind that applying for a CD loan may result in a hard credit check which could temporarily affect your credit score. However, if you're approved, you'll receive funds either by phone or online depending on the lender's policies. So take these steps seriously and soon enough, you'll have access to the loan details that work best for your needs and budget!

Related reading: Ncsecu Cd

Discovering the Fundamentals of Deposit CDs: An Introduction

Deposit CDs, or Certificate of Deposit, are a long-term savings vehicle that can help you earn more interest than a regular savings account. They work by locking in your money for a specific period, ranging from a few months to several years. During this time, your deposit CD pays interest at a fixed rate, which is typically higher than what you would earn with a regular savings account.

However, it's important to note that if you need to withdraw your money before the specific period ends, you'll likely face a steep penalty. For example, if you have a three-year term and need to withdraw your money after only one year, you may lose all of the interest you've earned and even some of your principal. On the other hand, once your deposit CD matures, you can either take out the money or move it into another CD without penalty. In most cases, if you don't do anything when the CD matures, it will automatically renew for another term at the prevailing interest rate offered by the credit union.

Expand your knowledge: Cd Secured Loan

The Ideal Candidate for a CD Loan: Do You Fit the Bill?

CD loans are a great option for individuals who want to build credit or cover emergency expenses. The ideal candidate for a CD loan is someone who has no credit score or a low credit score, as well as those who want to avoid paying high-interest rates on traditional loans.

Additionally, CD loans are perfect for those who are willing to use their CDs as collateral. CD secured loans require collateral, which can be a great way to get approved even if you have no credit score. However, it’s important to remember that removing funds early from your CD may result in withdrawal fees versus the early withdrawal penalty associated with traditional loans. All in all, if you fit the bill and need some extra cash, considering a CD loan could be an excellent option for your financial needs.

Check this out: Bet 365 Online Banking Withdrawal Time

Frequently Asked Questions

How does a CD personal loan work?

A CD personal loan is a type of secured loan where a borrower uses their certificate of deposit as collateral. The interest rate on the loan is typically lower than an unsecured personal loan and the borrower can still earn interest on their CD during the repayment period.

What can a secured loan be used for?

A secured loan can be used for various purposes such as home renovations, purchasing a car or consolidating debts. It requires collateral, such as property or assets, to secure the loan and typically offers lower interest rates than unsecured loans.

What can I do with my CD funds?

You can invest your CD funds in other financial products, renew the CD, or withdraw the funds. It's important to weigh the pros and cons of each option before making a decision.

How do you borrow against a CD?

To borrow against a CD, you can use it as collateral for a loan from your bank or credit union. The amount you can borrow will depend on the value of your CD and the terms of your lender.

What is a CD and how does it work?

A CD, or Compact Disc, is a digital storage medium for music and data. It works by using a laser to read tiny bumps on the surface of the disc, which are then translated into binary code that can be played back through a speaker or displayed on a screen.

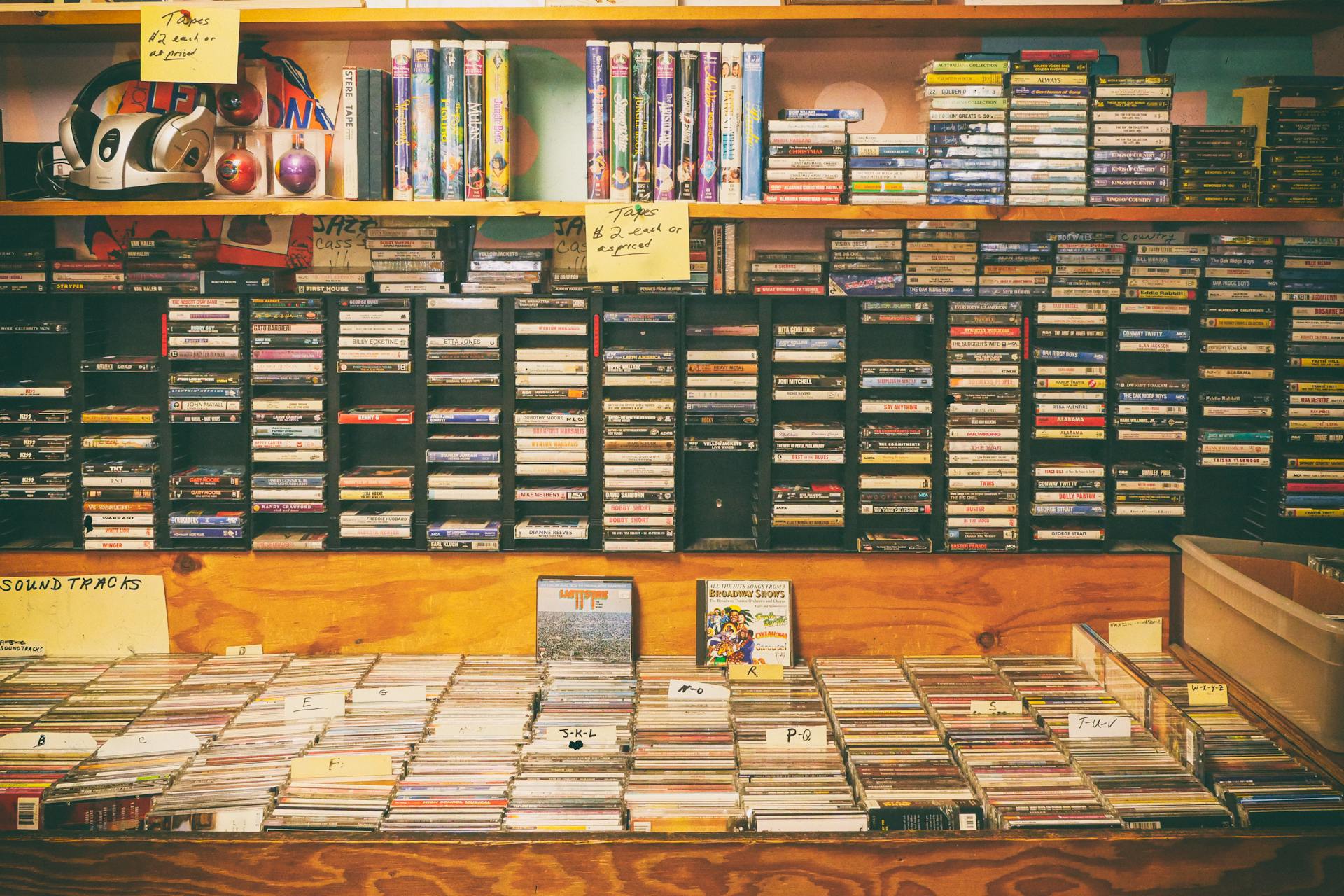

Featured Images: pexels.com