The Bank Bailout Bill is a piece of legislation that has been making headlines recently. The bill proposes to provide American banks with billions of dollars in federal aid to help them recover from the financial crisis caused by the COVID-19 pandemic. This has raised questions about how this money will be used and whether it will have lasting effects on the economy. Understanding what's contained in the Bank Bailout Bill is essential for understanding its impacts on our lives, so it's important to take the time to learn about it.

On top of providing financial assistance, this legislation also contains many other provisions that could affect the banking industry and consumers alike. It sets aside money to help small businesses and homeowners stay afloat during these difficult times, while also introducing new regulations designed to safeguard against future economic crises. These measures are intended to protect both banks and everyday citizens from another possible recession.

In addition, the bill provides funding for research into developing therapies and vaccines for COVID-19, which could be a crucial step in helping the economy recover from its current slump. By understanding exactly what's contained within this legislation, we can better understand how it could impact all aspects of our lives and make informed decisions when voting on its outcome.

You might like: H B L Power Share Price

Unveiling the Cost and Impact: The Story of its Passage

On October 3, 2008, President George W. Bush signed into law the bank bailout bill proposed two days earlier by Treasury Secretary Henry Paulson. The bill would allow the government to buy up to $700 billion in mortgage-backed securities from banks, hedge funds, and pension funds. Paulson wanted the purchase of these assets in order to help renew confidence in the global banking system and avert a full-blown financial crisis.

You might enjoy: Currency Trading Hedge Funds

Safeguarding Yourself from a Bank Bail-In

As banks remember the 2008 financial crisis, they have become more conscious of their financial security and are taking steps to ensure the same doesn't happen again. One such measure is the introduction of a bank bail-in bill, which seeks to protect account holders’ money should the bank run into financial difficulties. By following federal government guidelines relating to financial matters, banks can make sure that customers' money remains protected and their business is secure. With this in mind, banks and those investing in the financial markets can rest assured that their money remains protected and that their investments are safe from a potential bailout.

Curious to learn more? Check out: Class B Shares Private Company

Uncovering the Devastating Impact of National Debt

The 2008 Bank Bailout Bill sparked numerous debates that continue to have an impact on the United States' economic landscape today. Perhaps one of the most pressing issues is the ever-increasing national debt, which threatens to cripple the country's long-term fiscal stability. The original Paulson Proposal sought to address this mounting debt through a $700 billion bailout, however, by 2019 the United States annual budget deficit had already surpassed this amount - highlighting just how devastating the national debt can be. As the United States moves closer and closer to its federal debt ceiling, it is clear that decisive action must be taken in order to curtail its ever-growing financial burden.

Here's an interesting read: B H P Billiton Share Price

Unveiling the Urgency Behind the Bailout Bill

On September 16, 2008, Lehman Brothers filed for bankruptcy. This single day marked the moment when businesses across the world pulled their money from money market accounts and treasury bills, causing yields to skyrocket. Money market accounts were once considered one of the safest investments available, but on that day they became risky and unreliable. In response, the US Treasury Department agreed to insure money market funds in an effort to restore public confidence in these investments. At the same time, the SEC banned short-selling financial stocks in order to reduce volatility and keep stock prices from plummeting further.

By October 2nd, it was clear that federal intervention was necessary to prevent a complete economic collapse. Congress debated for weeks over what massive economic intervention political leaders wanted; blaming Wall Street for making bad decisions with mortgages and other financial products that had gone bad. Congress recognized that they must act swiftly to prevent a full-scale meltdown of banks due to fears of bad debt and fear feeding into debt ratings which drove stock prices down even further. This led to banks being unable to raise capital as a result of a resulting panic throughout the credit markets.

Ultimately, congress passed the bailout bill on October 3rd which included measures for government buying of bad mortgages as well as lowering both Fed Funds rate and Libor rates so banks could raise capital again without fear of stock prices plummeting or financial firms going under like Bear Stearns and Lehman Brothers did without federal intervention. The urgency behind passing this bill quickly was recognized by political leaders who saw that if it had not been passed right away then many more organizations would have joined them in bankruptcy court.

For your interest: Medical Accounts Receivable Factoring

Crucial Components in the Legislation

The Emergency Economic Stabilization Act, also known as the bank bailout bill, was legislation signed into law on October 3rd 2008. Key items in this crucial legislation deal with how to respond to the financial crisis of 2008. Public Law 110-343 provided key components to help stabilize our economy including credit assistance, insurance for certain securities, and oversight of executive compensation.

Recommended read: Is Key Bank a Good Bank

1. Interest on bank deposits held by the Federal ReserveEdit

The original bill proposed on September 20 contained a provision in Section 128 that allowed the Federal Reserve System to begin paying banks interest on deposits held at the Reserve Banks. This act allowed the Fed to pay a high interest rate to banks on their excess reserve balances, beginning October 6, 2008. Immediately after the Fed announced it would begin paying interest, banks increased their reserve requirements. In August of 2008, prior to the announcement of this policy, reserve balances had already begun reaching an all-time high due to a flight of capital from financial markets since September 11 2001. As time passed following the announcement, reserve balances began falling back to normal levels as the Treasury Department explained that one of the goals by allowing this move was for the Federal Reserve to take a leadership role in increased liquidity and effective functioning of US financial markets during a time of crisis.

The Fed's decision to pay interest on reserves provided an additional support for financial markets beyond its traditional monetary policy goals of maximum employment and stable prices. With this decision both the Federal Reserve and Treasury Department had provided incentives for market participants to provide additional support for term unsecured funding markets, with banks generally approving of earning high interest on their excess reserves rather than extend credit through commercial paper markets or other secondary sectors such as those of services economy shipping that rely heavily on credit availability. The ongoing credit liquidity crisis was also addressed with this decision and on October 7th Fed Chairman Ben Bernanke expressed his view that it was important for market rate credit risk premiums not be allowed to increase too much in order for credit availability not be choked off. The Fed adjusted its initial rate set on October 6th when it failed to keep overnight interest rates close to its policy target, announcing on November 5th that it would reason beginning December 18th pay interest directly established by itself instead of allowing required reserve balances alone determine how much interest was paid - which had been done since October 6th - as excess balances were calculated using formula based off their target federal funds rate set by themselves as well as short-term debt intended for use by government agencies only kept in non-interest bearing accounts.

Curious to learn more? Check out: Bank Interest Rates for Term Deposits Nz

2. Management of the Troubled Asset Relief ProgramEdit

The Troubled Asset Relief Program (TARP), included in the Bank Bailout Bill, authorizes the Treasury Department to purchase troubled assets from financial institutions, providing much needed financial stability. The Federal Reserve System, Federal Deposit Insurance Corporation, Office of Thrift Supervision and Department of Housing and Urban Development are all involved in this program. The Treasury Secretary is required to notify Congress within 15 days of any additional funding requests and if Congress fails to pass a resolution disallowing or opposing the request, then it is authorized after 15 days.

To further ensure proper management of TARP funds, the bill also authorizes the Treasury Secretary with the power to issue warrants for non-voting stock in firms participating in TARP and senior debt. To prevent excessive risks being taken by these institutions and to discourage unnecessary payouts that incentivize risk taking, golden parachute payments to senior executives will be limited and prohibitions on such payments expire December 31, 2009. In addition, debt positions must be held for longer periods of time than originally proposed and clawback permission is granted so that bonuses paid can be recovered if earnings gains based upon incentive pay turn out to be illusory. Lastly, the Treasury Department may purchase assets directly with de minimis exceptions and require meaningful equity or debt positions as well as offer incentives for good behavior when purchasing assets.

Broaden your view: Account Receivables Turnover Days

3. FDIC insuranceEdit

On October 3, 2008, the U.S. government passed a bank bailout bill which provided an additional layer of deposit insurance protection for consumers. The FDIC insurance coverage was extended to December 31, 2009 and provided an additional $250,000 of insurance per depositor beyond the traditional $100,000. This ensured that individuals' money would be safe even in the most dire economic situations. With this increased security, individuals could rest assured that their deposits were protected with the highest deposit insurance provided by the federal government.

Curious to learn more? Check out: Unsecured Loans Additional Finance without Collateral Demand

4. Budget-related provisionsEdit

"Title II Sets the Groundwork for Treasury Secretary to Act"

The recently-passed bank bailout bill contains a set of budget-related provisions that could make all the difference in whether or not the bill succeeds. Title II sets out the framework for the Treasury Secretary to purchase troubled assets from financial institutions and investors, and it is expected that this measure will help stabilize financial markets around the world. The Congressional Budget Office is also estimating that Title II will cost taxpayers up to $700 billion, making it one of the most expensive pieces of legislation ever passed by Congress.

By enacting Title II, Congress has given Treasury Secretary Henry Paulson unprecedented authority to act in order to ensure market stability and protect consumers from potential losses. It remains to be seen how effective these measures will be, but with such high stakes, everyone is hoping for a positive outcome.

Here's an interesting read: Regions Bank and Bill Have Partnered to Launch Regions Cashflowiq.

5. Tax provisionsEdit

The Bank Bailout Bill recently passed by Congress makes several changes to the tax law. For qualified financial institutions, the bill allows them to count losses on FHLMC preferred stock as ordinary income instead of capital gain income. It also includes provisions that limit executive compensation for corporations participating in government bailout programs.

Additionally, the bill extends the Mortgage Debt Forgiveness Provision from the Mortgage Forgiveness Debt Relief Act of 2007 and applies it to debts forgiven in calendar year 2012. This provision allows taxpayers to exclude from taxable income certain debts that have been forgiven by creditors. The expiration date for this provision is December 31, 2012. The bill also extends through December 31, 2009 the Section 41 Research Development Tax Credit which had expired on December 31, 2007. Finally, it increases the alternative simplified credit percentage from 14 percent to 16 percent for tax years beginning after December 31, 2008 and before January 1, 2010.

For more insights, see: Mental Illness Debt Forgiveness

Debating the Initial Proposal - What's the Verdict?

The verdict of the initial bank bailout bill proposed by Congress, including conservative free-market Republicans and liberal anti-corporate Democrats, is still being debated. The plan that occurred early in 2008 was initially opposed by Alabama Republican Spencer Bachus for its lack of oversight. However, after continued lobbying from both sides, it appears as though a compromise may be reached.

1. Immediate market reactionsEdit

On September 19, 2008, the bailout proposal emerged and the U.S. stock market rose in response. Foreign currencies corrected slightly after having dropped earlier in the day, and the dollar dropped compared to world currencies. On Monday, September 22, front end oil futures contracts spiked for the biggest one-day gain since trading began and massive spikes were seen in oil prices as traders rushed to purchase oil by buying large batches of October contract sessions. As a result, oil futures contracts rose up to $130 per barrel while mortgage rates increased significantly due to the bailout plan. By the week ending September 25th, mortgage rates hit an average rate not seen since early 1990s recession.

Consider reading: Trade Futures Contracts

2. Potential conflict of interestEdit

The current plan created by former Treasury Secretary Henry Paulson and Goldman Sachs, the bailed out firm, has raised questions of potential conflict of interest. In 2008, several Goldman Sachs executives were hired as part of Paulson's team and joined the banks that received bailout funds. The original proposal also exempted Paulson from any judicial oversight, leading some to question whether any illegal activity had taken place.

Neel Kashkari, a former Goldman Sachs executive and Treasury staff member responsible for overseeing the Troubled Asset Relief Program (TARP), was chosen by Paulson to lead the bailout program. Senate Senator Judd Gregg (R-NH), a leading Republican author of the bill, was also an early advocate for TARP and had multimillion-dollar investments in Goldman Sachs. With such close ties between these key decisionmakers and the financial institution receiving taxpayer funds, it is no surprise that questions have been raised about potential conflicts of interest when it comes to this bank bailout bill.

Related reading: Treasury Stock Method

3. Views from the public, politicians, financiers, economists, and journalistsEdit

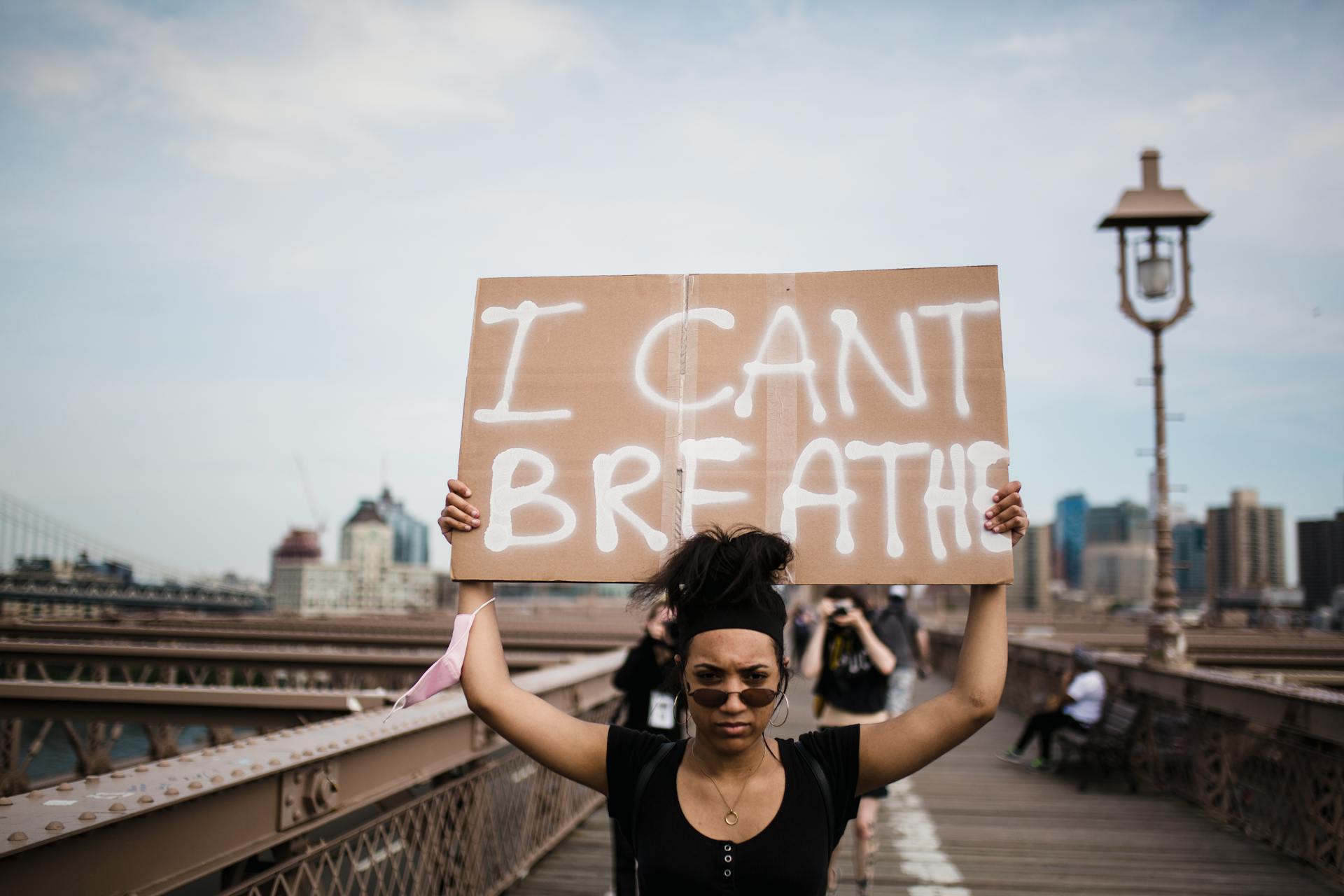

Protests opposing the bank bailout bill occurred across 100 cities in the United States on Thursday, September 25. A grassroots group called TrueMajority organized members for a total of 251 events in 41 states. The largest gathering was in New York City, where over 1000 protesters gathered outside the New York Stock Exchange. Labor union members organized by the New York Central Labor Council and other grassroots groups also planned rallies in Chicago, Los Angeles, San Francisco and other cities nationwide. Outraged citizens continue to express their opposition online with dedicated web sites like BailoutOpposition.org. According to a Pew Research Center survey conducted in September, 57 percent of Americans opposed potentially investing billions of taxpayers dollars to rescue ailing private financial firms while only 30 percent supported it as a way to keep markets secure. 55 percent thought it was the wrong thing for Congress to do with taxpayers' money, while 31 percent were opposed because it would give taxpayer dollars to private companies. This survey was conducted before the Bush Administration unveiled its plan through the Treasury Department to buy distressed assets from financial companies; 56 percent of respondents wanted Congress to reject the original Paulson proposal while 22 percent supported it in its initial form. Only 11 percent wanted Congress to pass the Paulson proposal as is. Senator Sherrod Brown reported that his office had received 2000 e-mail messages and telephone calls on that day alone - roughly 95 percent of which were opposed to the plan that included buying troubled mortgage-related assets from banks and other financial institutions. In all, Brown's office received 39180 e-mails and calls by Tuesday – an overwhelming majority against the bailout plan.[1]

Additional reading: Attica Bank E Banking

Skirting the Bank Bail-In: Avoiding a Costly Bank Crisis

As the recent bank bailout bill has shown, it is essential for bank customers to understand how to avoid bankruptcy and the costly bank bail-in that can make or break their financial stability. Fortunately, there are steps that customers can take to keep their savings intact. Understanding financial regulations, working with credit unions, and staying informed about the activities of large financial institutions are all important ways to ensure that a bank crisis does not become a personal crisis.

For more insights, see: Turkish Economic Crisis (2018–current)

Final Word on the Bottom Line

The Bottom Line on the Bank Bailout Bill: The financial crisis of 2008 and the Great Recession that followed taught big banks an important lesson. After receiving billions in bailouts, they are now repaying back the federal government. This shift in policy has allowed financial institutions to access debt capital while ensuring that debtholders, unsecured creditors, shareholders, and other stakeholders involved with the financial sector remain safe.

So what does this mean for the bottom line? The tips outlined in a progress report from pages 35-36 of Economic Policy Research on bail-ins, bank resolution, and other government policies helps investors understand investing regulations and laws. It is important for investors to understand the strategies outlined by the Federal Reserve when it comes to investing laws so they can properly educate themselves before clicking “accept” or enhance their site navigation and analyze their site usage for marketing efforts.

Overall, it is clear that the bottom line on the bank bailout bill was successful because of how far we have come since 2008. From European Parliament deals being reached to government policies implemented related to investing regulations, there has been a lot of progress made over the years. For more information about this progress report including pages 35-36 of Economic Policy Research on bail-ins, bank resolution, and other government policies can be found online.

Intriguing read: Federal Bank Online Banking

European Adventure: Examining the Effects of Bail-Ins

The European Union (EU) has taken an approach to bank bailouts that is starkly different from the one adopted by the federal government of the United States. In order to address bank failures, EU countries have implemented a "bail-in" policy which takes into account some of the underlying economic issues that have led to high debt levels and risky investments.

Key examples of this policy are evident in Cyprus, where the government joined the EU in 2004 and was subsequently saddled with a large amount of debt due to its exposure to the volatile Greek market. The country's large domestic lenders were also deep in debt due to risky loans they had made, leading to a level of government intervention not seen in other countries. This intervention took the form of a bail-in policy forcing depositors with balances exceeding 100000 Euros to accept losses as part of their financial packages. The alarming rate at which this occurred was intended to help create stability and growth coupled with more responsible banking practices.

Dangerous Difference: Bank Bail-in vs Bank Bail Out

The government injects capital into the banking system to enable major banks, and other financial institutions, during times of financial crisis. Historically, the government has bailed out large banks such as America BAC Citigroup and American International Group (AIG) with taxpayer funds.

Unlike bailouts, which give relief to banks by providing additional funds, bail-ins work differently by providing a buffer for the banks by requiring unsecured creditors including depositors to take losses in order to stay afloat. Put simply, bail-ins act as a way of ensuring that capital requirements are met without having to resort to taxpayer dollars.

In a bail-in situation, while deposits at the bank remain insured up to $250,000 by the Federal Deposit Insurance Corporation (FDIC), unsecured creditors such as depositors and bondholders fall after derivative claims derivatives. The Dodd-Frank Act requires that 25 largest banks hold enough liquid assets to offset any potential calamity in the financial system - this is done through the use of bailouts or bail-ins. Bailouts give banks additional funds when required; however bail-ins require that equity takes precedence over shareholders and debtholders alike – this is done so that taxpayers do not have to bear the brunt of covering losses at these banks. The primary objective of both bailout bills and bailout-ins is to protect American taxpayers from having to foot the bill for losses at major banks.

Take a look at this: American Banks in Puerto Rico

Governing Justice: Mastering the Law

In 2008, the United States Government passed the Emergency Economic Stabilization Act which authorized a $700 billion capitalization program. This program was designed to provide special assistance to banks whose camels ratings suggest they would not withstand severe losses and loose money due to their construction loan portfolio and non-performing loans, also known as troubled assets. The New York Times states that this money appears to be culling banks based on criteria that is loosely defining. Banks who receive capital from this program must present a specific business plan and may merge with a partner before they can receive capital.

The Capitalization Program appears to suggest that only those banks who have lost money due to the financial crisis should receive capital; however, many banks who were not in deep trouble have received funds through this program for various reasons. The program is meant for all banks whether or not they had lost money, as long as they meet certain criteria.

The Mastering of the Law when it comes to governing justice is an important aspect of understanding why certain decisions are made regarding bank bailout bills. It is important for those involved in deciding which banks receive capital and how much, have a firm understanding of the law and the impact it has on our financial system.

Check this out: Why Is Investing Important

Shield Your Valuables From Harm

The recent bank bailout bill is a controversial topic that has been widely debated in the financial sector and amongst governments across the world. This bill seeks to ensure that troubled banks are able to avoid bankruptcy by injecting money back into them and providing protection for unsecured creditors. Governments are taking steps to ensure that consumers, banks, and other financial institutions remain financially secure while avoiding failure in the wake of this pandemic.

The federal government has implemented policies such as bailouts, bail-ins, and large derivative purchases with the intention of protecting bank deposits and mortgage books. To keep a watchful eye on any potential risks in the financial markets, they have introduced various forms of regulation and oversight to guarantee financial stability.

By implementing these measures, governments are attempting to create a secure environment for all stakeholders involved; from banks, consumers, large derivative traders to global financial markets. Despite potential problems along the way, governments are confident that their policies will help protect valuable assets from harm and ensure that we remain on a path towards economic recovery.

Worth a look: Which Bank Is Most Secure for Online Banking

Saving Troubled Assets With the Relief Program

The Troubled Assets Relief Program (TARP) was established in 2008 with the passing of the bank bailout bill, originally designed to help reverse auction troubled banks with the bid price for their troubled assets. TARP Administrators would purchase the distressed assets at the lowest price possible to provide an influx of capital into these banks so that they could continue offering credit and help homeowners refinance their loans.

The Treasury Department purchased preferred stock in many leading banks as part of its Capital Purchase Program, lending money to member banks and even insurance giant American International Group (AIG) and auto companies through its Term Asset-Backed Securities Loan Facility. By October 14, 2008, TARP funds had been approved by Congress.

By October 3, 2010 the Treasury had recouped losses from most of its investments but some TARP funds were still used to implement President Barack Obama's stability plan which included nationalizing certain companies in order to increase homeowner affordability. The goal was for taxpayers to eventually be able to recoup any losses incurred from TARP funds due to the financial industry crisis.

Worth a look: Are Us Treasuries Safe

Unveiling the Hidden Benefits of TARP

On September 20 2008, Secretary Paulson submitted a three-page proposal to the house that proposed forcing taxpayers to reward bad banking decisions. Supporters added that if the house voted no on September 29 2008, the result would be catastrophic; global markets would have plummeted. This was ultimately why the TARP bill passed and what made it so successful - by preventing further economic damage and restoring confidence in the global markets.

Check this out: Kuwait Finance House

1. Note

On October 3rd 2008, the Dow Jones Industrial Average fell 77768 points - the largest single-day point drop in history. In response to this panic-stricken climate, the Senate reintroduced a bank bailout bill known as the Emergency Economic Stabilization Act of 2008 (EESA). It included provisions to help homeowners facing foreclosure and guarantee home loans, as well as assist homeowners in adjusting mortgage terms. It also increased the Federal Deposit Insurance Corporation limit on bank deposits and allowed banks to tap into federal funds if necessary.

The EESA also included a mark-to-market rule which forced banks to value mortgages at present day levels instead of their probable true worth. The bill also gave tax breaks and alternative minimum tax patches for hurricane survivors. A vote from the Senate gave final approval for the bailout plan, along with oversight committees headed by Federal Reserve Chair Ben Bernanke, SEC, Federal Home Finance Agency, Secretary of Urban Development and more. Bailout installments began in November 2008 with government taking equity stakes in rescued firms who received assistance. Other provisions added restraints on executive compensation at troubled firms and a way for taxpayers to recoup losses from financial industry giants.

Suggestion: Federal Takeover of Fannie Mae and Freddie Mac

Frequently Asked Questions

When was the economic relief bill enacted?

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was enacted into law on March 27th, 2020. This historic economic relief bill provides much-needed assistance to individuals, businesses, and industries across the United States. Learn more to see how it can help you!

What is the difference between bail-in and bailout?

Bailout refers to financial support given to a company or sector by external sources, such as governments, while bail-in is the restructuring of a company's debt to save it from bankruptcy. Bailout is often considered a last resort measure when all other options have failed, while bail-in can be used as a preemptive measure.

How did the government bail out banks?

The government provided banks with financial assistance through the Troubled Asset Relief Program (TARP) to help stabilize the banking system and prevent further economic decline in 2008. Learn more about how banks were bailed out and the effects of TARP.

What is the 2008 stimulus bill?

The 2008 stimulus bill, also known as the American Recovery and Reinvestment Act, was a $787 billion economic package designed to create jobs and stimulate the economy. It included tax cuts, infrastructure investments, and assistance programs for struggling individuals and businesses.

Are bail-ins the new norm?

Yes, bail-ins are becoming more widespread as a result of regulatory changes and increased economic uncertainty. Read on to learn more about why bail-ins have become the new norm.

Featured Images: pexels.com